The Solution That Doesn't Exist

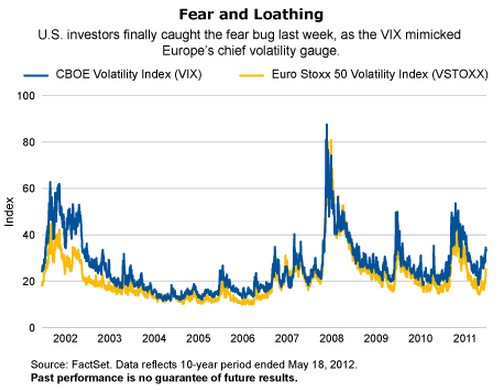

Europe's problems are simple: every country in Europe -- there are no exceptions, not even Germany -- borrows to pay for promises that their own economy hasn't got the resources to pay for. The same is true in the US, but it hasn't become front burner yet. It will. Ultimately, you run out of people willing to loan you the money to pay for things that you otherwise can't afford. It's not as if the US and Europe are borrowing to build bridges. That might represent a legitimate reason to borrow. Instead the indebtedness is a result of current funding needs that will only escalate over time. When does social security and medicare get less expensive? This is the heart of the European problem. They are not borrowing to fund long term investments, they are borrowing to fund the welfare state. Put another way, they are borrowing for current consumption. The consumption being funded is part and parcel of the way of life in Europe, as it is in the US. There is no real